While financial gurus like to sound like they have some special insight into the market, no one has a crystal ball.

We’ll be the first to admit it.

Investing is about doing your due diligence.

Of course there are tools that can give a savvy investor some inside clues about the market.

It’s a little known technical indicator that measures an important statistic known as “market breadth” called the Advance/Decline Line.

It’s a tool that actually can give you a glimpse at the internal strength or weakness of any market. And best of all, it’s super-simple to use…

A Look “Inside” the Market

Market “breadth” shows the relative participation in a market move by measuring the number of shares that are moving higher versus the number moving lower — in other words whether a rally is broadly-based or being driven by a few big stocks.

The math on this is ridiculously simple.

You just take the number of shares going up (usually over a trading session) and subtract the number of shares that went down. Then add that number to the previous day’s number.

Voila! Instant market insight.

The A/D line (as it’s known) can be a leading indicator by showing a deterioration in market strength if it starts to lag as prices are making new highs. It can also show accumulating strength in a bear trend by holding previous lows while prices are still heading lower.

Now that you understand the principles behind this indicator, let’s take a look at the A/D lines for four major indexes…

Four Indexes — Four A/D Lines

Let’s start with the big dog…

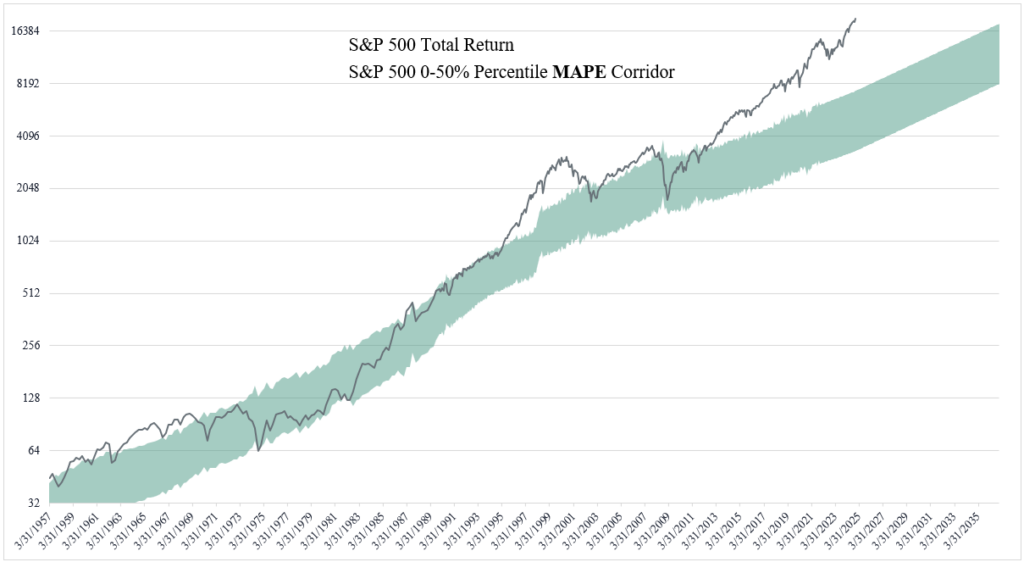

S&P 500

Look at the A/D line in the first circle compared with the price action. Market breadth appeared to be weakening as the A/D line couldn’t reach a new high with the market. It eventually did post a new high, but then fell off sharply as the market stalled.

Right now the indicator appears to be relatively in line with the price action of the market. But continued weakness into the new year could mean more internal weakness.

Dow Industrials Average

Source: MarketInOut

The Dow Industrials is only a 30 stock index, but it also contains $12.5 trillion in market cap with Nvidia, Apple, Microsoft and Amazon. So it’s got some pretty mega-tech companies to drive it.

You can see the upward price bias throughout November, while the A/D line stayed basically flat. Year end profit taking pulled prices a bit back in line. But absent a confirmation by the indicator, new highs in the market should be viewed cautiously.

NASDAQ Composite

If you want a look at a troubling chart, look no further than the Nasdaq Composite. The Nasdaq is a capitalization-weighted index of 2,500 companies that lean heavily toward the tech sector.

The index was up over 30% in 2024 while its A/D line had been heading significantly lower for most of the year.

The price action is closer to what we’ve seen in the S&P 500 (another market-cap weighted index) but given the index contains 5-times as many stocks, this divergence between price and AD line drives home the fact that the rally is still in the hands of a handful of mega-tech companies.

Russell 2000

The Russell 2000 is an index of small cap companies.

Small caps have been struggling. While the S&P 500 gained over 24% last year, the Russell Index managed less than half that rallying 10.8%. Here you can clearly see the divergence between the A/D line and the price action of the index. New price highs were made, but market breadth didn’t support it.

The pullback has brought prices back into line somewhat, but the fact that the A/D line has moved so far below previous lows may be indicating the market is still under some stress.

As Always: One Caveat…

To be sure, this indicator is not the “holy grail” of investing. There are no sure things.

When it comes to the markets, “only price pays” — no matter what your indicators may be telling you, price is the only indicator that really matters!

Everything in your technical arsenal could be screaming “sell, sell, sell,” but if the market keeps going higher… It’s going higher. (Have another look at the Nasdaq Composite chart!)

It’s no secret that for the past two-plus years, it’s been basically a handful of stocks — the AI/mega-tech sector — that has been pulling the market higher. And they’ll continue to be an influence.

But all that said, technical indicators like the advance/decline line can offer important insights into what may be building internally in the market.

And that’s always important for a smart investor to know.