They’ll never say it out loud, but the position of Treasury Secretary is basically your mom.

The high-profile, cabinet-level position is basically in charge of paying the bills, collecting the income and managing the finances — pretty much like your mom did way back when.

Unlike your mom, the Treasury Secretary is also in charge of overseeing national banks, printing currency (not like the Fed, but actually printing and minting bills and coins), enforcing financial laws and prosecuting financial criminals and tax evaders.

These are all important jobs. But one of the most important that your mom also doesn’t get to do is weigh in on fiscal policies. Fiscal policy refers to how the government spends its money.

As the government doesn’t actually “create” value, it doesn’t really “earn” money. So for the record, fiscal policy is how the government spends other peoples’ money.

To obtain this money, the Treasury Department levies taxes on its citizens. And what that money can’t cover, they borrow.

Since the turn of the millennium, there have been eight people from both sides of the aisle to hold the office. During that same time, the national debt has increased by 523%.

Thanks to this irresponsibility two major credit rating companies downgraded the US’ credit rating under the terms of Timothy Geithner in 2011 and Janet Yellen in 2023.

(That is terrible fiscal planning that threatens our economy overall.)

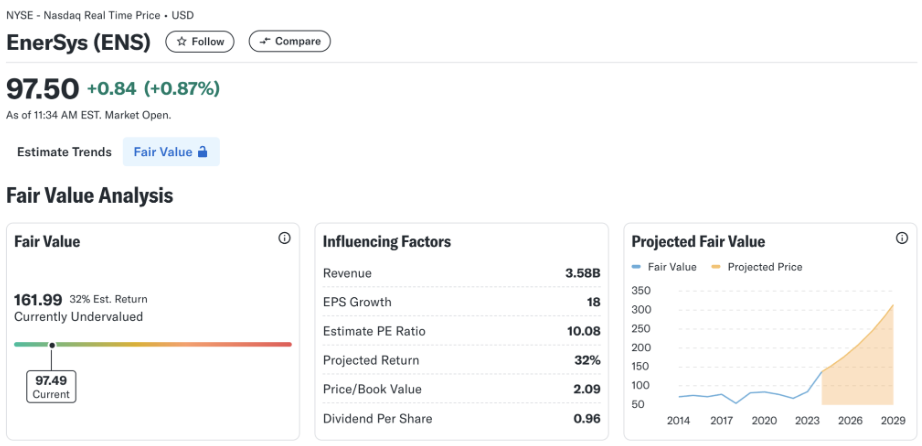

So when a new Treasury Secretary is nominated, markets generally have a say…

The New Guy on the Hill

Recently, President-Elect Trump nominated Scott Bessett to take over the job in his administration.

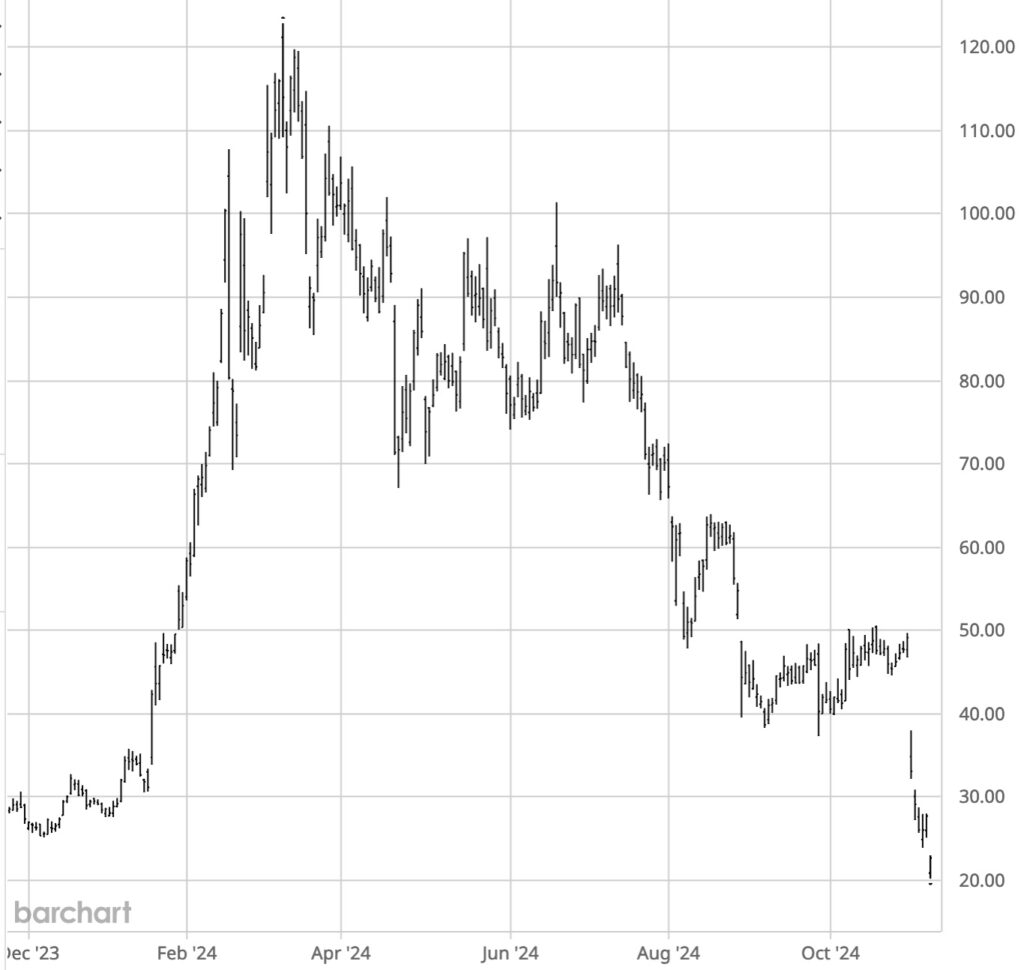

The following Monday, the Dow Industrials erupted, soaring as much as 519 points on the news.

It would seem the market approved. Bessent does represent a change from the current Treasury administration.

Janet Yellen has been a lifelong academic and a career bureaucrat.

Bessent on the other hand, has a background in the market. The letters behind his Yale degree only reach to BA (but he was a member of the Wolf’s Head Society — one of Yale’s three “secret” societies — so that’s gotta count for something).

He basically made his bones in the market working for Soros Fund Management (yes, that Soros) where he was on board during the Black Wednesday crisis where his boss crushed the British Pound.

He left Soros in 2000 to start his own hedge fund which shut down in 2005. He returned to Soros where he stayed until 2015 when he went off to start another fund, the Key Square Group.

While some may wonder about his Soros-related pedigree, he is a guy with in-the-trenches experience in financial markets.

A Deeper Look

Bessent is a “macro” investor — a strategist who considers macroeconomic and geopolitical factors — which gives him a real-world perspective on what works and what doesn’t where the economy goes.

Among his stances around the incoming president, he’s promised to take action on Trump’s tax cut plans. Including “making his first-term cuts permanent, and eliminating taxes on tips, social-security benefits and overtime pay.”

He’s been a vocal critic of the US’ debt load which the bond market should find interesting. In a plan to help get the debt under control he’s promoted the ideas of reducing government spending. And freezing non-defense discretionary spending.

This will be an important focus as Congress will have to re-implement the debt ceiling it suspended in 2023.

He’s also proposed an economic policy he calls “3-3-3.” According to the Wall Street Journal:

Bessent’s “three arrows” include cutting the budget deficit to 3% of gross domestic product by 2028, spurring GDP growth of 3% through deregulation and producing an additional 3 million barrels of oil or its equivalent a day.

But most notable is his stance on Trump’s tariff policies.

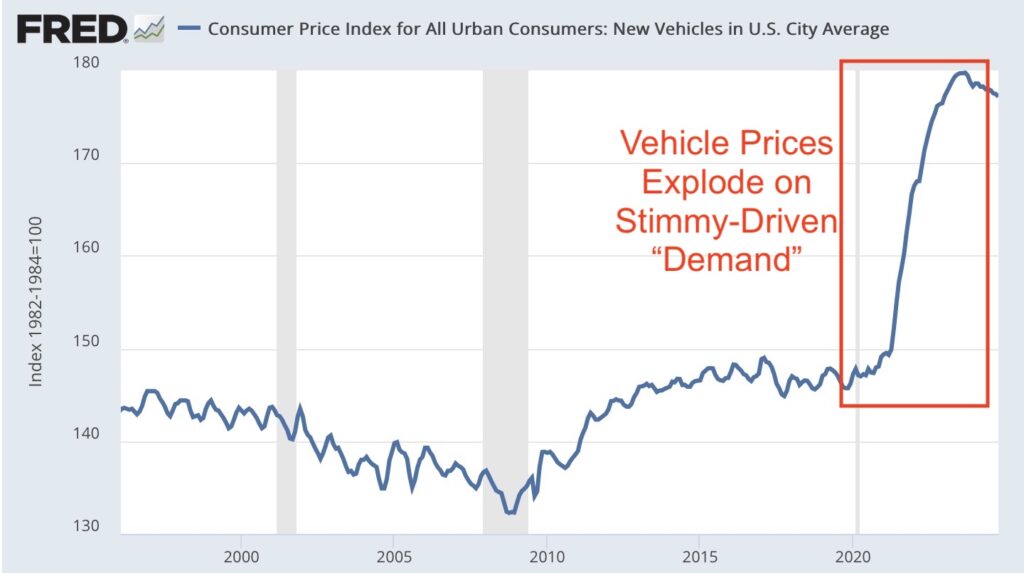

Tariffs have been the most controversial aspects of Trump’s economic plan. Opponents have called it mercantilist and protectionist promising higher costs for consumers.

Bessent backs Trump’s ideas on tariffs, just not all at once. Taking a more gradual approach, “Bessent said he favors that they be “layered in” so as not to cause anything more than short-term adjustments.”

Bessent called for tariffs to resemble the Treasury Department’s sanctions program as a tool to promote U.S. interests abroad. He was open to removing tariffs from countries that undertake structural overhauls and voiced support for a fair-trade block for allies with common security interests and reciprocal approaches to tariffs.

Seeing Bessent as a backer and a balance for the incoming POTUS, the market has approved of the choice thus far.