The stock market did something amazing in 2024.

Something it hadn’t done in a quarter century…

No kidding.

The market, as measured by the S&P 500 put in back-to-back 20% or higher gains.

In 2023 the S&P 500 closed up 24%. Last year it added another 23%.

Want to be even more impressed?

Since the index was founded in 1957, it has only accomplished this incredible feat of strength six times. That’s around once a decade on average.

So what does that portend for the coming year?

Let’s look at a couple influencing factors.

That Last Time…

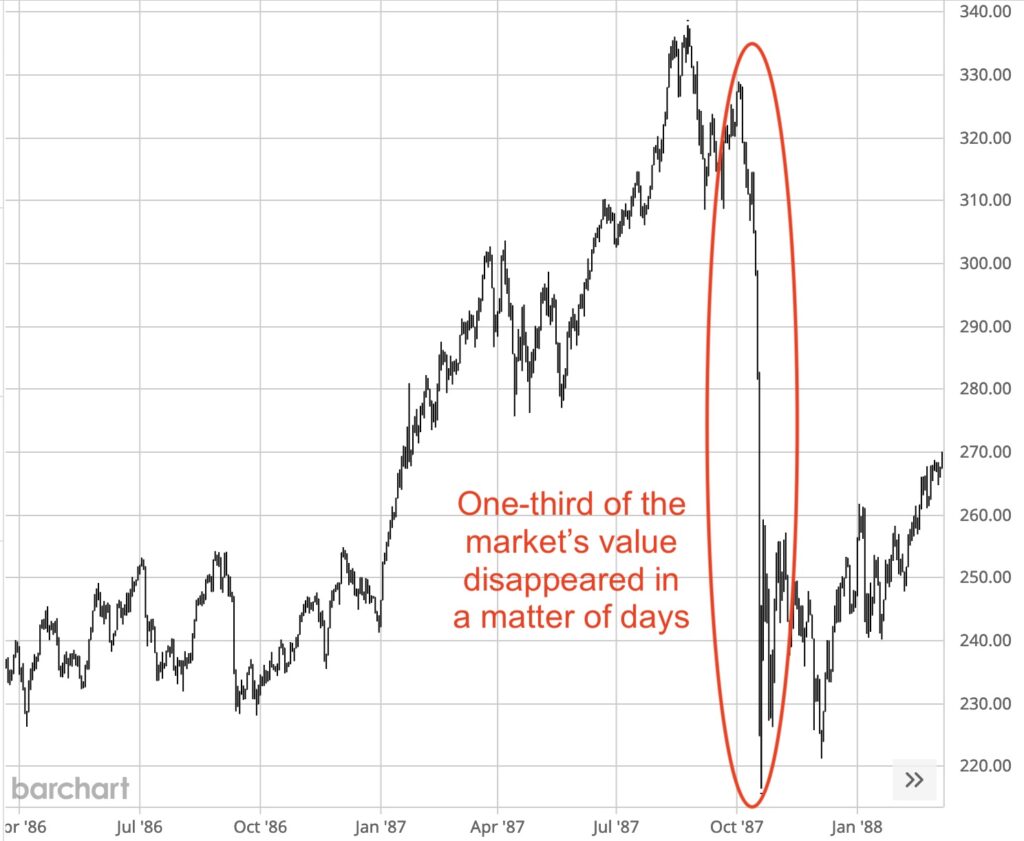

The last time investors were popping the bubbly over back-to-back gains like this was in good old 1999.

We suspect every investor over 40 remembers what happened after that…

The turn of the millennium brought with it the bursting of the internet bubble and ushered in the era of what’s fondly become known as the “tech wreck” — the kickoff of a decade-long bear market.

Now to be fair, the initial bear leg bottomed after only two years and a 47% washout. And while the ensuing rally attempt got off to a great start gaining 26%, the next four years put in more modest gains ranging from 3% to 14%.

The building optimism, however, was short-lived when the market was clubbed like a baby seal in 2007 by yet another exploding bubble — the housing/mortgage bubble and the disaster known as the Great Financial Crisis — which cost the market 37%.

All in all, the years between 2000 and 2009 were nothing to write home about. From the final high to the final low, the index lost nearly 50% of its value.

And it all came on the heels of back-to-back 20%-plus gains.

Is it time to get nervous?

Sons of the Tech Bubble

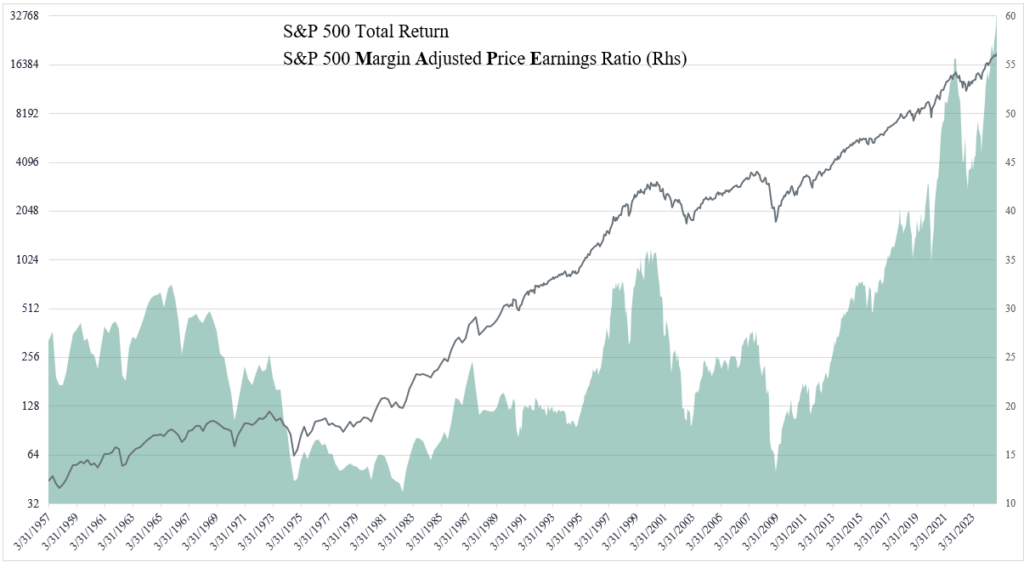

When we look back at those dismal years, it’s important to note that four of those six 20%-plus performances were all put in between 1995 and 1999. THAT… is unprecedented.

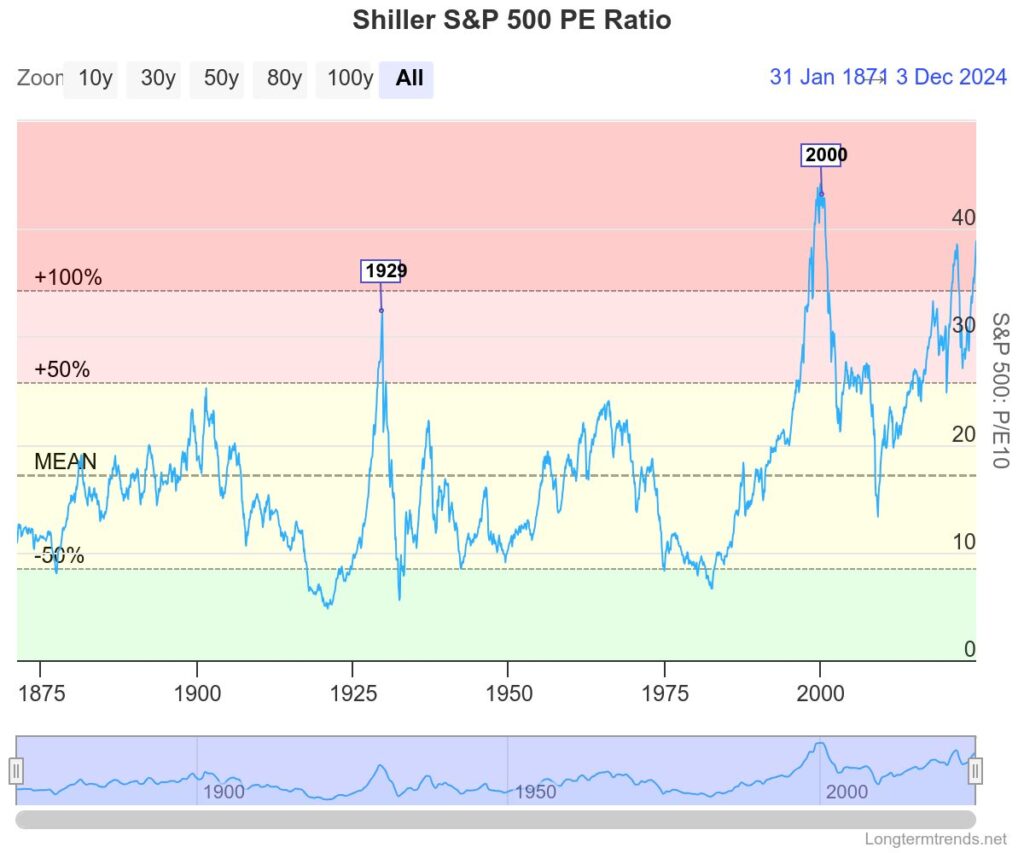

Of course the tech bubble was the era of the new investing paradigm. When insane valuations didn’t matter anymore because it was all about the internet — and that was going to change everything.

Of course it didn’t.

Hundreds of stocks trading at thousands times earnings will never be profitable. Ever. The pretenders were dispatched in short order.

And in a potentially great irony, today’s multi-year performance might actually be considered an offshoot of that bubble. Because it’s being driven by a select number of mega-tech companies that survived the bust and grew up out of the boom.

You know them today as the “Mag 7” — multi-trillion dollar market cap monsters. (With Tesla and Meta playing catch-up.)

These “big dogs” have fully been the driving forces behind both years’ successes.

They’ve been such forces they’ve been able to push the market higher even in the face of the Fed’s manic rate hike cycle.

They’re able to do this because they’ve got so much cash in their war chests, they don’t give a hooey about higher rates. Case in point, Microsoft has already indicated they plan to spend a cool $80 billion on data center expansion in 2025. That’s a 44% increase from last year.

And that’s not all. According to Morgan Stanley Amazon could spend $96.4 billion… Google could spend $62.6 billion… and Meta could spend $52.3 billion.

Fed looking to dial back rate cuts in 2025? They don’t seem to care.

And why not?

Because they’re all jockeying for position in what might well become the next great bubble…

AI.

Investments in the nascent technology have been pretty rampant, and with good reason:

The industry is still in its infancy, but Wall Street’s forecasts suggest AI could add anywhere between $7 trillion and $200 trillion to the global economy during the next decade.

Those are big numbers.

But they’re also forecasts (best guesses).

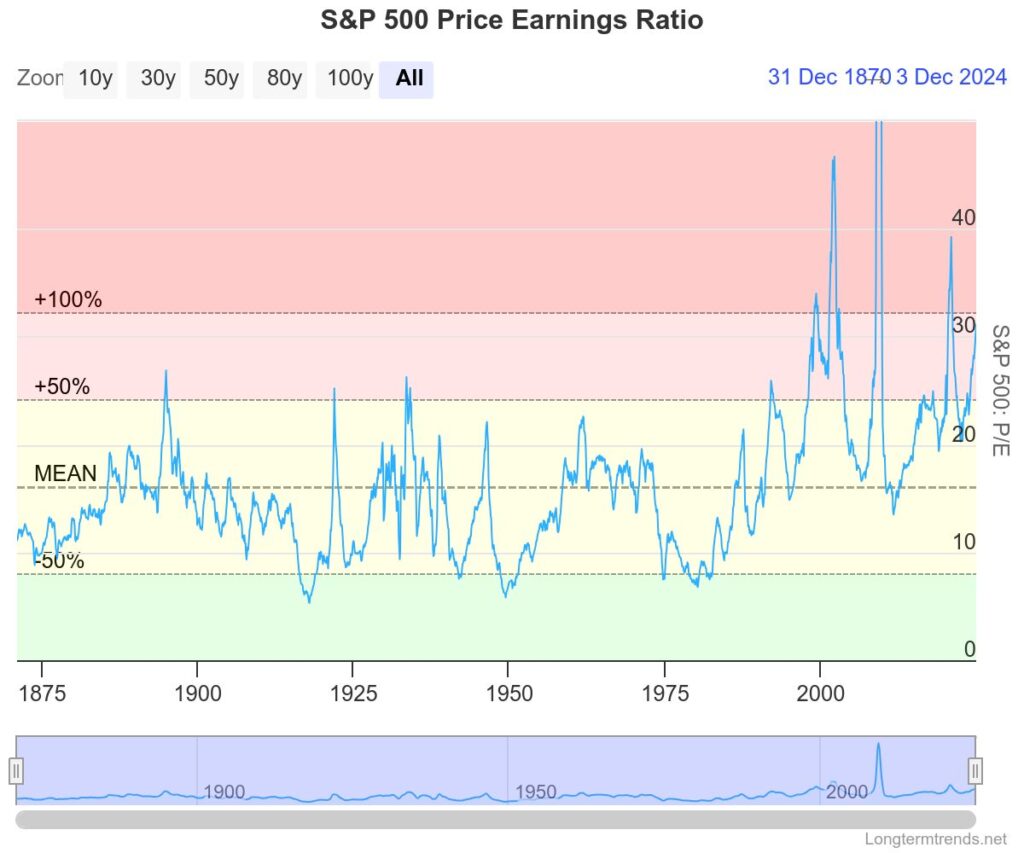

And in chasing their share of the pie, the valuations of these companies driving these supers-sized gains are starting to become a little rich.

The 2024 PE for the Mag 7 came in around 40 vs 27 for the entire index. Forward PEs see valuations coming off a bit to 32.3 and 23.2 respectively.

Now, these rising PEs aren’t exactly 1990s tech bubble rich, but rich nonetheless. And the extensive capital expenditures will have the effect of eating into future margins. As reported in Reuters…

“I think what investors are missing is that for every year Microsoft overinvests – like they have this year – they’re creating a whole percentage point of drag on margins for the next six years,” said Gil Luria, head of technology research at D.A. Davidson.

Typically investors don’t see a bubble until it’s in their rearview mirror. And what would one look like in this case anyway? A move to more reasonable valuations within the Mag 7 would likely make for a year (or more) of struggles in the broader market.

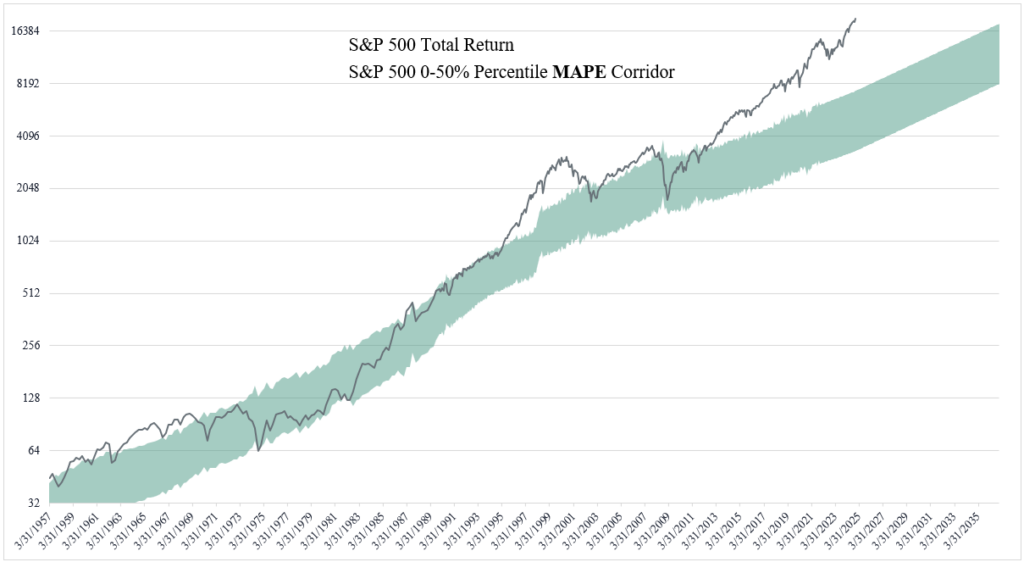

On the other hand, if the index can complete the 20% trifecta this year that means S&P 500 levels around 7050.

Stay tuned…