The FOMC is closed out 2024 this week.

While humbly bragging that inflation is well under control, they’ve set off in search of more “neutral” interest rate levels to ward off any slowdown in the economy.

Most media will tell you that they have spectacularly engineered the elusive “soft landing.” And that you don’t realize how good you’ve got it!

Others would beg to disagree..

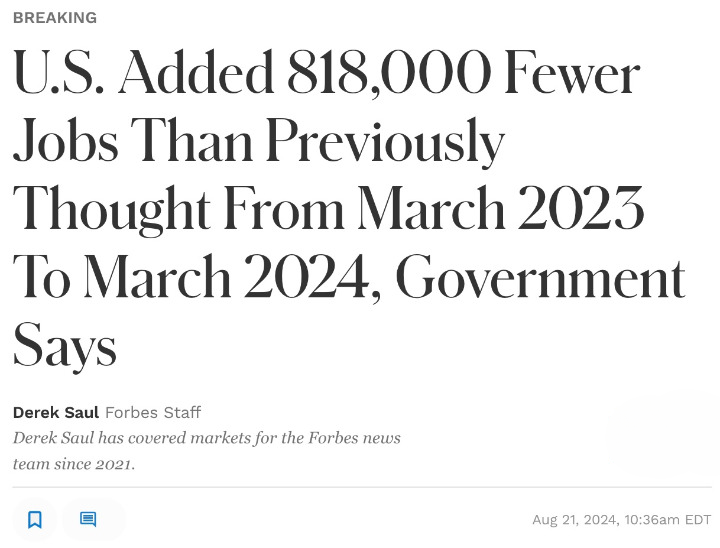

They’ll point out Donald Trump won the White House in pretty amazing fashion based on the fact that Bidenomics and the economy it created both sucked.

Each camp comes to their conclusion based on the measuring stick they use.

And there’s more than one way to measure an inflation monster…

Welcome to “Sticky-ville”

As if there weren’t enough ways to demonstrate how badly the economy is treating you, the Atlanta Fed itself has devised another. It’s called the Sticky-Price CPI.

What is that?

The Atlanta Fed started tinkering with this measure nearly ten years ago. The idea behind it is that some items in the CPI basket change very rapidly in response to economic factors (they’re known as “flexible”) while other items change much more slowly (they’re “sticky”).

The big question on everybody’s mind was whether either of these groups was a better predictor of different drivers of inflation. In other words, was either one a better forecast tool.

After examining the data for a bit, they discovered that half of the categories change their prices every 4.3 months. So they used that as their cut off.

Items with prices that changed more frequently (like, say, tomatoes) were dubbed “flexible” while those that moved less frequently (like coin-operated laundries) fell into the “sticky” basket.

When you plot the two categories, they look pretty much like you’d expect:

But the trillion dollar question was still was either basket a better predictor?

To determine that, they dove into some high-level math. They used something called the root mean squared error (RSME) which is a statistical way to measure how accurate a prediction is.

They compared the RMSE of each basket to the RMSE of the forecast produced from the headline CPI at intervals of one month, three months, 12 months and 24 months out. (We’ll skip the boring math discussion.) What you need to know is that according to the Fed…

A relative RMSE less than 1.0 indicates that the alternative proxy for inflation expectations is more accurate than the headline CPI.

The results were undeniable.

The one month forecasts were all about equal. But, starting with three months out, the sticky and core sticky baskets proved to be better forecasters. And they became even better predictors the further out they went.

Forecasting Trouble

So what are they showing as the FOMC’s year came to a close?

The Atlanta Fed’s sticky-price consumer price index (CPI)—a weighted basket of items that change price relatively slowly—rose 2.4 percent (on an annualized basis) in November, following a 3.6 percent increase in October. On a year-over-year basis, the series is up 3.8 percent.

On a core basis (excluding food and energy), the sticky-price index rose 2.4 percent (annualized) in November, and its 12-month percent change was 3.9 percent.

The year-over-year numbers are double the Fed’s “mandate.”

While their “preferred” inflation gauge, the PCE index, is showing headline inflation around 2.3%, other measures like core CPI which hasn’t been below 3% since April 2021, suggest that things are still not under control.

And considering the Atlanta Fed’s sticky forecasting tool, it may not be for a while.