It’s finally over…

After enduring months of some of the most incredible political theater ever exhibited, including two assassination attempts on a candidate, the citizens of the US finally stepped up and made their voices heard. And boy did they ever.

In what can only be described as the comeback of all time (unless you’re a member of the Grover Cleveland Fan Club), Donald Trump won the presidency in undeniable fashion.

And not only did he win, Republicans also took back control of the Senate — and are gaining ground in the House.

This was a remarkable red wave. The kind that gives the winning candidate a mandate to enact their policies. And since Trump now has that mandate, it’s probably worth taking a look at what the next four years (two years with a friendly congress) might bring for the economy and markets…

Stocks

There was no mistaking the stock market’s opinion of Trump’s victory. The day after the election, the Dow Industrials rallied over 1,400 points. The S&P 500 soared over 130. The Nasdaq composite was up over 500. And the Russell 2000 (the index of small to mid-cap companies) saw the highest percentage gain of all the averages exploding over 120 points.

The initial explanation is simple: Trump will be a pro-business president.

You can expect Trump to bring a lighter regulatory touch to his next term. He’s also indicated his preference for lower interest rates (a point of contention with us). This bias should benefit tech where AI (and crypto) are concerned as well as the energy sector.

Inflation

This is a tough one. Because in all honesty, no one administration can be blamed for the inflationary forces in the economy.

Inflation isn’t a bug within our financialized economy, it’s a feature. One of the “mandates” of the Federal Reserve is to maintain price stability. They define that as maintaining (creating!) 2% inflation every year. That may not sound like much but it shows up as a 22% increase in prices over the course of 10 years. Nothing compared to what the economy experienced over the last four, but the point is prices rarely ever go down.

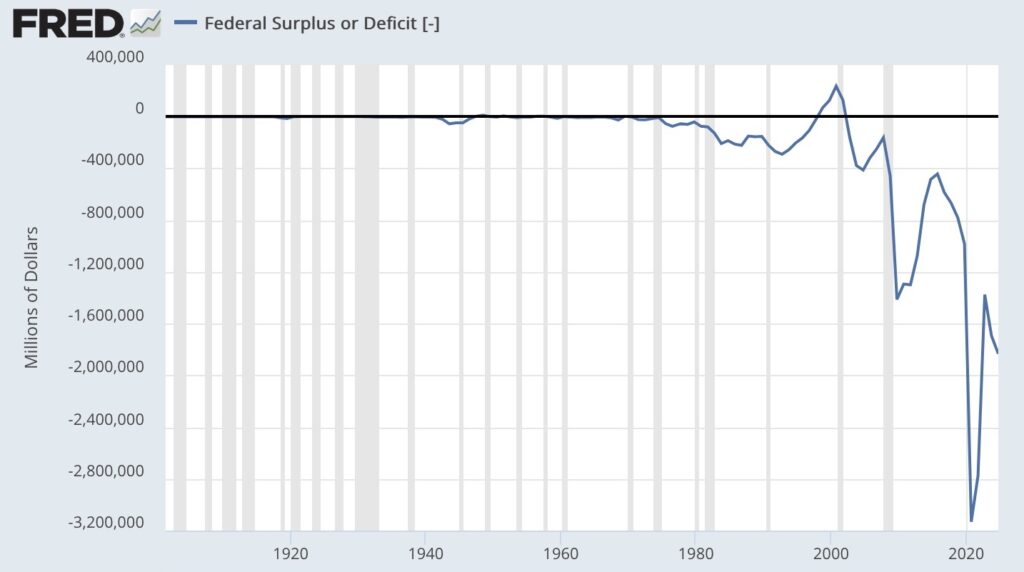

Of course the fiscal side of the ledger carries a lot of blame as well. Deficit spending, theoretically a cure for a struggling economy (not one that’s booming like they tell us ours is), has an inflationary impact on the economy. Thanks to Congress, the US deficit has been running rampant for the last two decades. And given the fact that they suspended the debt ceiling over a year ago, it’s hard to see how anyone can make much of an impact here.

The Federal Deficit

It’s finally over…

After enduring months of some of the most incredible political theater ever exhibited, including two assassination attempts on a candidate, the citizens of the US finally stepped up and made their voices heard. And boy did they ever.

In what can only be described as the comeback of all time (unless you’re a member of the Grover Cleveland Fan Club), Donald Trump won the presidency in undeniable fashion.

And not only did he win, Republicans also took back control of the Senate — and are gaining ground in the House.

This was a remarkable red wave. The kind that gives the winning candidate a mandate to enact their policies. And since Trump now has that mandate, it’s probably worth taking a look at what the next four years (two years with a friendly congress) might bring for the economy and markets…

Stocks

There was no mistaking the stock market’s opinion of Trump’s victory. The day after the election, the Dow Industrials rallied over 1,400 points. The S&P 500 soared over 130. The Nasdaq composite was up over 500. And the Russell 2000 (the index of small to mid-cap companies) saw the highest percentage gain of all the averages exploding over 120 points.

The initial explanation is simple: Trump will be a pro-business president.

You can expect Trump to bring a lighter regulatory touch to his next term. He’s also indicated his preference for lower interest rates (a point of contention with us). This bias should benefit tech where AI (and crypto) are concerned as well as the energy sector.

Inflation

This is a tough one. Because in all honesty, no one administration can be blamed for the inflationary forces in the economy.

Inflation isn’t a bug within our financialized economy, it’s a feature. One of the “mandates” of the Federal Reserve is to maintain price stability. They define that as maintaining (creating!) 2% inflation every year. That may not sound like much but it shows up as a 22% increase in prices over the course of 10 years. Nothing compared to what the economy experienced over the last four, but the point is prices rarely ever go down.

Of course the fiscal side of the ledger carries a lot of blame as well. Deficit spending, theoretically a cure for a struggling economy (not one that’s booming like they tell us ours is), has an inflationary impact on the economy. Thanks to Congress, the US deficit has been running rampant for the last two decades. And given the fact that they suspended the debt ceiling over a year ago, it’s hard to see how anyone can make much of an impact here.

The Federal Deficit

In 2018 and 2019, Trump levied tariffs on products valued at roughly $380 billion.

But as you can see in the chart above, inflation remained fairly stable (even declining into 2019).

That said, the economy was doing better back then than it is today. The ISM Purchasing Manager Indexes for both manufacturing and services were well above the 50 threshold signaling business growth. Today, services are still intact while manufacturing has slipped to more contractionary levels.

A weaker economy might not react as well.

There are other Trump policies the economy will be facing — especially in the area of geopolitics.

We’ll consider them in future posts.