A few months back, West Texas Intermediate flirted with the high-$50s, and the commentariat exhaled a collective sigh of relief…

“See?” they said. “The oil market is flush, tariffs or no tariffs.” It felt reassuring, like sticking a piece of tape over a flashing check-engine light.

Yet that sense of comfort comes from a fantasy: whispers about OPEC “just about” to flood the market and presidential proclamations about everlasting U-S-of-A energy dominance.

Strip away the talking points and the fundamentals are already tightening…

Shrinking Rigs, Shrinking Reserves

Efficiency gains let shale drillers do more with fewer rigs—until they can’t…

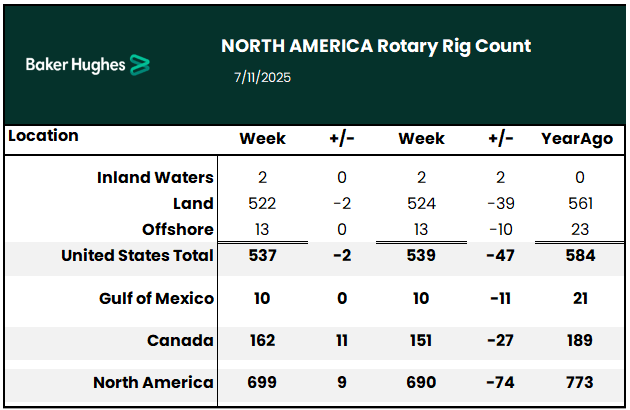

The Baker Hughes rig count has been sliding for years, and July is expected to bring another leg down. You don’t park iron unless the best rock no longer works at today’s prices.

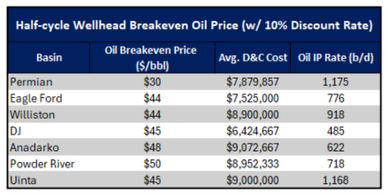

Right now the only acreage still making money under $60 is the absolute cream of the crop. And drillers are fast chewing through those sweet spots, too.

That reality is showing up in the books…

After a decade of bragging about ever-growing reserves, the United States posted a 3.9% year-over-year drop in proved oil and condensate for 2023, even as output rose nearly 8%.

North Dakota alone lost 12.3% of its proved barrels thanks to fewer rigs turning to the right.

And, just in case you were confused, flat-lining production and shrinking reserves are nobody’s definition of an oversupplied market.

The Strategic Petroleum Pickle

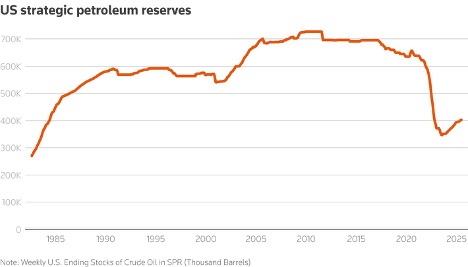

Remember the 180 million barrels President Biden dumped from the Strategic Petroleum Reserve to calm prices and win votes after Russia invaded Ukraine?…

The SPR still hasn’t been refilled. That leaves the White House—any White House—with the thinnest emergency cushion in modern memory.

When the next supply shock hits, there’s no government lifeline to keep gas stations calm…

OPEC Smoke-Signals and Shale Mythology

Analysts keep parroting anonymous “OPEC sources” who swear July’s ministerial meeting will green-light a production hike. Maybe…

More likely those leaks are leverage plays—talk the price down without adding a single extra barrel. And even if the cartel does open the taps, history says it’s because demand is roaring back, not because spare capacity is brimming over.

Meanwhile Wall Street still believes U.S. shale can crank forever…

The truth: drillers are marching from tier-one rock to tier two and three, where costs rise and flow rates fall.

That’s why even with record-high lateral lengths and digital-twin well planning, total Lower 48 production slipped in April versus March.

The shale miracle isn’t dead—but it’s a lot older, slower, and more expensive than the spreadsheets suggest.

When the Dam Breaks

Today’s oil strip looks like musical chairs…

As long as the music plays—cheap crude, easy narratives—money managers stay parked in AI and green-energy darlings.

But fundamentals always crash the party.

And the second headline sentiment flips from “glut” to “tight”—maybe a refinery fire, maybe the first Gulf storm of the year—the herd will sprint back into barrels and the $70 ceiling will disappear.

History punishes those who wait for CNBC to bless the trade…

Think 2007, when oil vaulted from $50 to $147 in under two years. Or 2022, when WTI leapt 60% in six months while analysts were still predicting $40.

Cheap crude is a mirage, not a new normal. And mirages vanish fast.

Your Next Move

Smart investors aren’t staring at line charts hoping for $45. They’re hunting for operators that can stay profitable in the $60s yet gush cash when crude rips through $90.

That field narrows every year as legacy shale sweet spots deplete and mega-caps chase global LNG…

The true growth stories live in the smaller, scrappier corners of the patch—names drilling second-generation horizontals in under-appreciated basins at half the cost of the majors.

No Time Like the Present

If you want to learn where the real upside hides, start with the only growth names left in the oil patch—companies like Prairie Operating Company…

This Denver-Julesburg Basin up-and-comer boasts some of the lowest breakeven prices in the industry, setting it up to explode with profit as the era of bargain-basement oil draws to a close.

Discover why outfits like Prairie Operating Company (NASDAQ: PROP) could become tomorrow’s legends—before the crowd finally wakes up and the easy money is gone.

Disclosure: Neither The Investment Journal nor the author have a financial position in any of the companies mentioned in this article. An affiliate of The Investment Journal has been retained for marketing services by Prairie Operating Company (NASDAQ: PROP) between July and August; however, this is not a sponsored post. This content is for informational purposes only and should not be considered investment advice or a solicitation to buy or sell any securities.