Trust us… They’ll be screaming that it’s all because of Trump’s tariffs.

But it won’t.

We’re referring to a potential resurgence of inflation.

For months leading up to the election, when they weren’t blasting him as the second coming of Hitler, Stalin and Mussolini…

…the Democrat side blasted his tariff talk as an outright financial assault on Americans.

“It would be a sales tax on the American people,” she [Harris] said in an interview with MSNBC on Wednesday. “You don’t just throw around the idea of just tariffs across the board, and that’s part of the problem with Donald Trump… He’s just not very serious about how he thinks about some of these issues.”

They’ll want you to believe that any uptick in prices will be all on him. But should inflation begin to reheat, you need to know that it’s been building for some time.

Inflation is Under Control

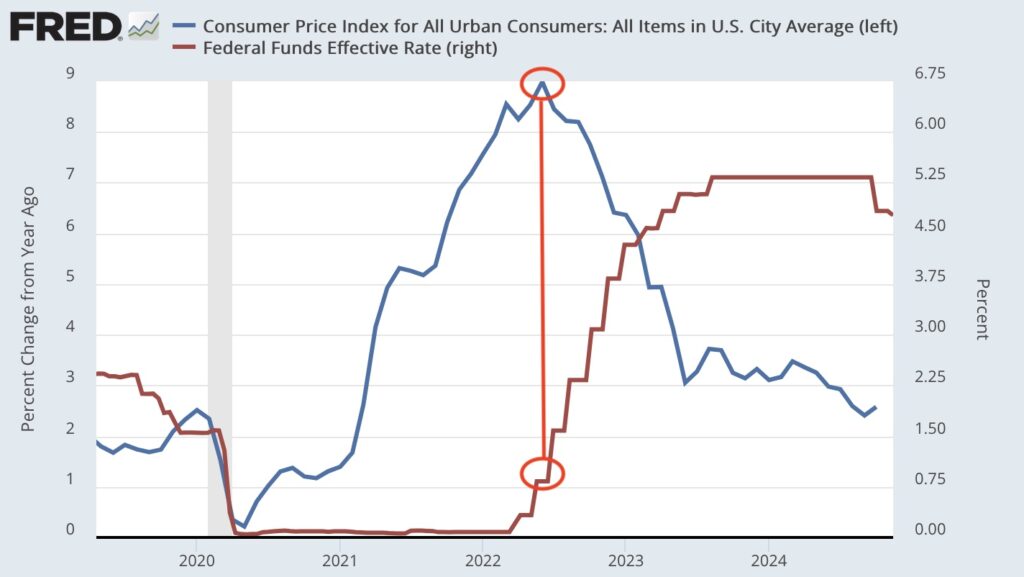

The Consumer Price Index came out last week and the numbers were reported in line across the board.

The headline number was up 2.6% year-over-year in line with estimates but 0.2% higher than the previous month’s report. The infamous “core” measure (minus food and energy costs) hit expectations and was flat from the previous yearly reading.

The media rushed to emphasize this was all good news…

The only problem is that the core number is stuck at 3.3%.

If you buy the Fed’s talk about them seeing inflation back under control so they can start moving rates back to neutral, you’d be hard pressed not to notice that the core reading hasn’t been below 3% since March 2021.

Ordinarily the talking heads try to explain away any high print in CPI by saying “well look at the core measure” and blaming it on food and energy prices. It’s true, those prices are volatile. And when they’re pressuring the headline index higher, it’s a legitimate observation.

But when the opposite happens, like now, it’s just as legitimate.

In fact, for the past several months, it has been food and energy prices that have been pressuring the index lower. And when you take them out you get a clearer picture of the overall price situation as it stands.

Prices are stubbornly stuck well above the 3% level. Which, in inflation terms, is nowhere near the 2% level the Fed views as its mandate.

That’s called persistent inflation.

And it’s a problem.

Or Is It?

Two days after the Journal headline trumpeted that everything on the inflation front was still A-OK, Jay Powell came out at a speech in Dallas and dumped cold water on it.

“The economy is not sending any signals that we need to be in a hurry to lower rates,” Powell said in remarks for a speech to business leaders in Dallas. “The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.”

Remember that three years ago, as prices were accelerating like a Space X super heavy rocket, the Fed (and that sage of the Treasury, Janet Yellen) all insisted that it was “transitory.” Not long after scraping that egg off their face, the FOMC kicked rate hikes into high gear.

After doing nothing for two whole years and watching inflation skyrocket to 9.1%, they want you to believe that their massive rate hike of three-quarters of one percent was the thing that struck fear into the heart of rising prices and brought inflation to heel.

It wasn’t. (Businesses reopened and the broken supply chain worked itself out.)

But when you consider that all the indexes in the CPI are subject to “seasonal adjustments,” that the data doesn’t account for costs like interest rates, homeowners insurance, shrinkflation and other assorted rising costs, that financial conditions (according to the Chicago Fed’s National Financial Conditions Index) were never meaningfully tightened and that money supply (M2) is back on the rise looking to test its all-time high of $21.7 trillion you get the idea that we’re not out of the inflation woods by a long shot.

The inflation beast is something that’s been developing for the past three years. If it takes a turn back to the upside — which is a possibility — it shouldn’t be on Trump.