Famed investor Cathie Wood’s ARK Invest made headlines earlier this week with a significant adjustment to its portfolio, notably selling off its holdings in small module reactor (SMR) tech company Oklo Inc. (NASDAQ: OKLO).

Oklo, a nuclear power startup backed by OpenAI’s Sam Altman, has surged recently, rising 20% to $31.25 on January 21 and an additional 6.6% to $33.27 early on January 22.

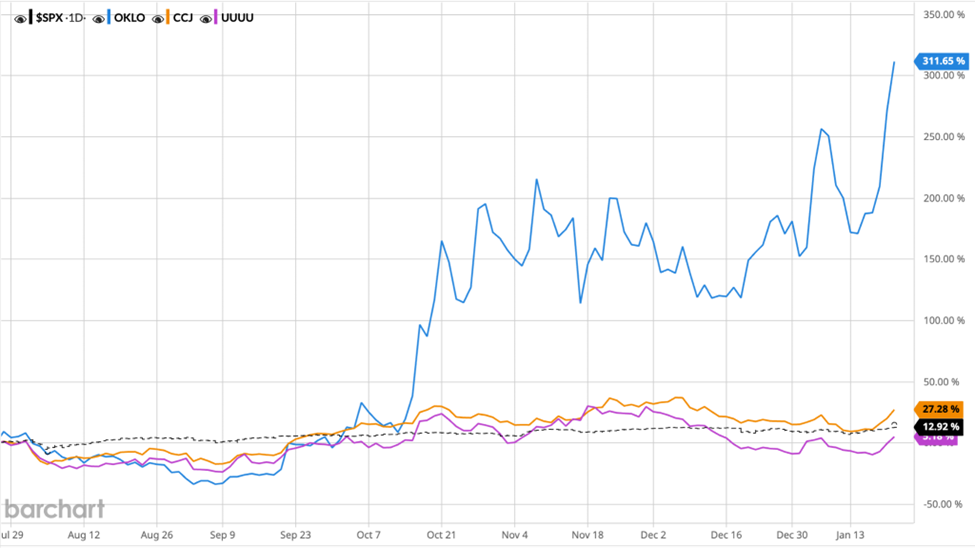

The company is up as much as 311.65% over the last six months, blowing away competitors in the uranium and nuclear energy space as well as indexes like the S&P.

Notably, at the same time Wood was locking in her profits with Oklo, ARK Invest increased its position in Cameco Corporation (NYSE: CCJ), one of the world’s largest uranium producers.

It’s surely no coincidence that this repositioning happened a day after President Trump announced a potential $500 billion private sector investment to fund infrastructure for AI, including a joint venture called Stargate with OpenAI, SoftBank, and Oracle.

This AI infrastructure initiative is expected to dramatically boost electricity demand, with tech giants looking to nuclear power as an inevitable solution.

That “inevitability” could be why Wood has reconfigured her portfolio away from the explosive but unproven tech company (Oklo) to the staid but profitable commodity play (Cameco).

Though in the same general sector — nuclear energy — the two companies are an exercise in contrast.

Despite making certain investors a tidy profit with its triple-digit stock price growth, Oklo is pre-revenue and has no definitive sales agreements as of the time of this writing. And though the company’s investor materials note that it is making good progress toward its goals, it is still burning cash at the rate of approximately $24.9 million a year.

Compare that to uranium giant Cameco — a far more established company that is revenue positive (to the tune of $2.8 billion in the most recent fiscal year) with a profit margin of about 4.17%.

ARK Invest’s nuclear shuffle could simply be an exercise in locking in profits from a higher risk, higher reward investment then reallocating to a lower risk investment that still has the potential to outperform the market in general, as Cameco has done over the last 2-3 years.

But it is interesting to note that the strategy involves moving away from a specific technology and toward a company that is going to fuel that technology.

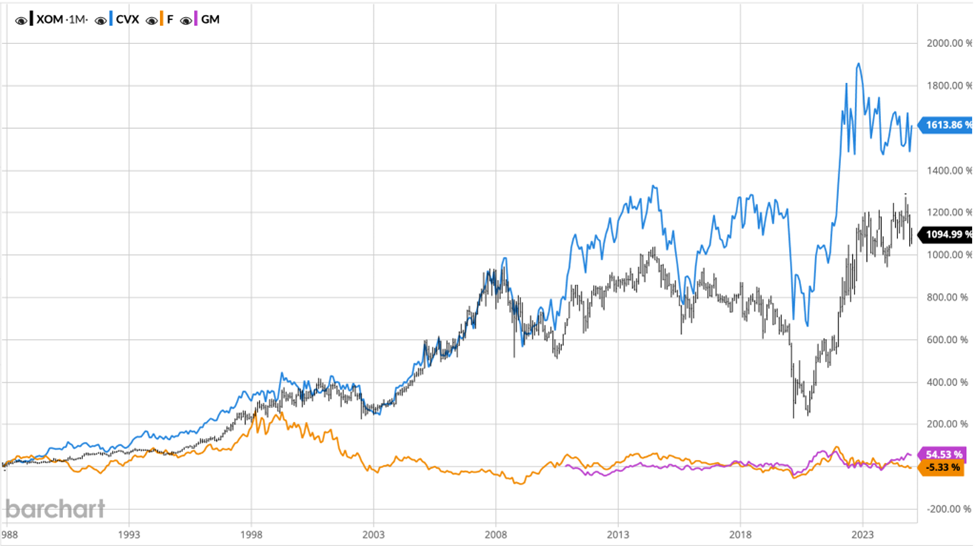

By way of analogy, it could be akin to selling Ford or GM in favor of investing in the one thing both companies’ products need: gasoline.

ARK Invest’s partial divestment of a nuclear reactor tech company in favor of a uranium producer could be an exercise in risk reduction … or it could be a sign that Wood expects uranium producers to break out sooner rather than later.

Either way, one thing is for sure: One of America’s most famous investors appears to be bullish on the country’s nuclear future.