When asked what she would do to deal with inflation during her failed presidential campaign, Vice-President Kamala Harris repeatedly talked about battling the bogeyman of price gouging — the idea that retailers jack up prices to pad their profits

Now, never mind that many states have their own laws to deal with price gouging, her claim makes it seem like unscrupulous pricing practices have somehow been a root cause of the higher prices that everyone is struggling with.

Not so.

Let’s take a look at two areas where folks are most impacted by price fluctuations: the grocery store and the gas station…

According to the Grocery Store Guy, a site dedicated to tracking the industry, profit margins are definitely not the culprit…

Conventional grocery stores have a profit margin of about 2.2%, making them one of the least profitable industries in the U.S.

Gas stations on the other hand make the grocery industry look like Scrooge McDuck.

An analysis in Fortune Magazine pulled back the curtain of the industry to reveal…

Gas retailers receive a fraction of the price listed on the sign–their net profit per gallon is around $0.03-$0.07… This puts the net profit margin of a gas station at less than two percent.

Added up another way…

According to IBISWorld, gas stations make an average net margin of just 1.4% on their fuel.

So the idea of a fire hose of profits from retailers overpricing goods hardly matches with reality.

Of course, that doesn’t mean there isn’t some serious price gouging going on elsewhere…

If It’s Not the Grocery Store, Who is it?

If you really want to point a price gouging finger somewhere, you can look to none other than the Fed. Yep, your friendly neighborhood central bank has been in the business of gouging your prices for years.

But isn’t the Fed supposed to promote “price stability” you might ask?

Let’s consider that.

One of the Fed’s official “mandates” is to maintain a 2% annual rate of inflation. Why? Two reasons.

First, because by maintaining a stable rise in prices it sets an expectation in people’s mind. It reassures them that with the Fed in charge of monetary policy, prices won’t go soaring out of control. (Like they just did…)

The other factor is that 2% inflation is considered a margin of safety. What’s that mean? They insist that if the Fed were to attempt the Herculean task of maintaining a lower rate, they would risk creating a contractionary economic situation. Which would lead to recession and depression and all that stuff they can’t risk.

So 2% it is.

That’s their story. Problem is it’s all BS.

The 2% number is basically a random pick. (Watch as core CPI stays stuck above 3% you can bet the Fed will start floating “target range revision” talking points.)

But get past all the rationalizing of 2% inflation, you’ll realize that the Federal Reserve is actually in the business of creating inflation.

Why on earth would they want to do that?

Because in a financialized economy — one where fiat currency is more important than producing value — unchecked debt becomes the driving force to create “growth.” And at some point you have to deal with that.

You may have read that the federal black hole is now up to nearly $36 trillion. (What you may not have read is that there’s no longer a debt ceiling in place until 2025. We doubt it’ll even come back then.)

It’s reached 122% of GDP.

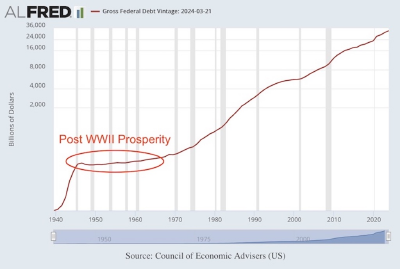

They have never nor will they ever pay that debt down. Here’s a chart of the government’s gross federal debt dating back to 1940…

The Federal Debt

Even during the economic boom during the post-war years the actual debt never got paid down.

The way they keep it “under control” is by managing it as a percent of GDP — in other words, through inflation.

And while they’re doing that, they’re devaluing your money.

So, while your local grocery is scraping by, it’s the Fed that has actually been robbing you blind for years.