Oh how the mighty have fallen.

Once the king of all coffee sellers, Starbucks has stumbled on hard times.

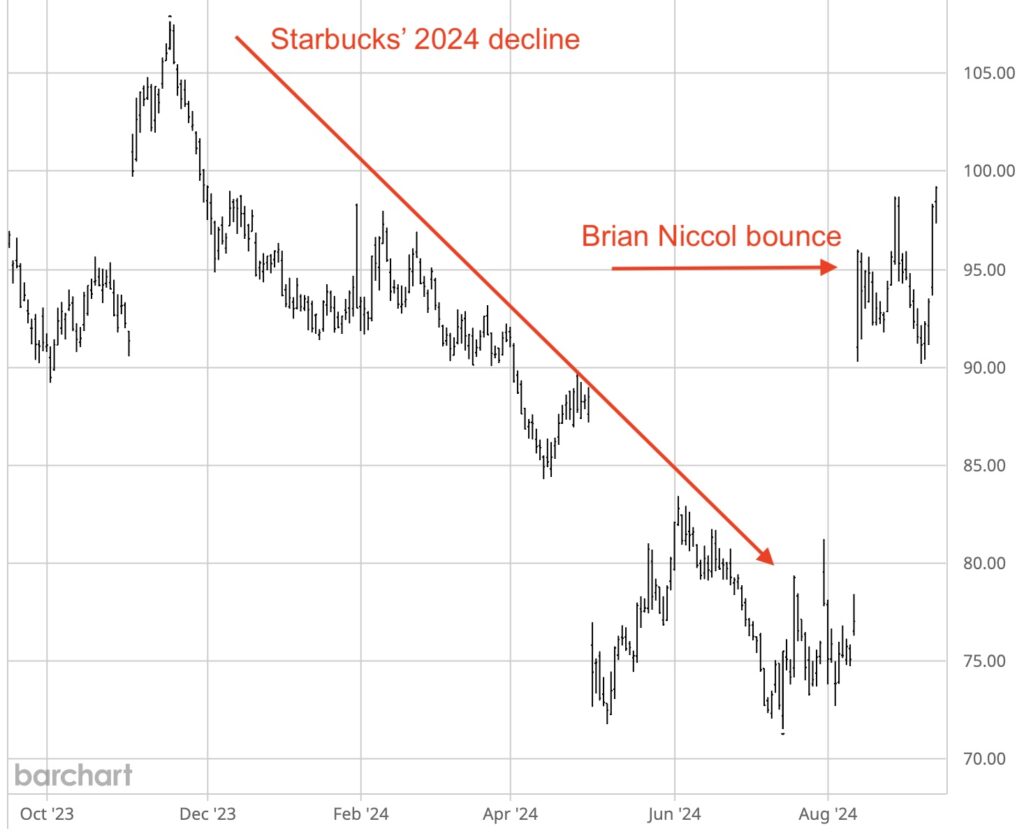

In fact, the whole of 2024 had been pretty much a disaster for the company.

The company reported a first quarter rise in revenue — but fell short of expectations by over 2%. To top that off, they slashed their guidance for 2024 from 10-12% to 7-10%.

Then in Q2 they reported revenues actually fell by 2% and further slashed guidance to the low single digits.

Q3 had to be the icing on the cake… Revenues fell for the second straight quarter with the company basically predicting its sales slump wouldn’t end anytime soon.

The company’s CEO Laxman Narasimhan did his best to smooth things over making statements like:

“In a highly challenged environment, this quarter’s results do not reflect the power of our brand, our capabilities or the opportunities ahead.”

Founder Howard Schultz wrote a lengthy piece where he offered a more practical suggestion

One of their first actions should be to reinvent the mobile ordering and payment platform—which Starbucks pioneered—to once again make it the uplifting experience it was designed to be.

I don’t know how “uplifting” an online app can be, but the company had been experiencing issues filling orders from it. At least Schultz’s suggestion was aimed at something concrete.

Either way, the market wasn’t buying it.

By the time they had reported their third quarter earnings (July 30) the company’s share price had collapsed nearly 22% by reporting time. The time for some dramatic change had come.

On August 13, in a surprising turn of events, CEO Laxman Narasimhan was dumped in favor of a new boss — Brian Niccol, former CEO of Taco Bell and Chipotle.

Niccol came with a pretty remarkable track record. According to the AP:

When Niccol arrived at Chipotle in 2018, the Mexican chain was reeling from multiple food poisoning outbreaks. Five years later, its annual sales had nearly doubled.

The stock jumped nearly 25% the day of the announcement.

Starbucks (SBUX)

Apparently the market thinks he’s the solution. But what’s really the problem?

A Victim Of Its Own Success?

Much of the discussion so far has focused on the company’s service.

There’s no doubt that Starbucks has been a leader in the coffee arena. Some 50 years ago, when Starbucks first opened its doors, coffee was coffee. As Starbucks brought the “coffee house vibe” to life, however, it also brought a series of new coffee creations.

Espressos. Lattes. Cappuccinos. Frappuccinos. Macchiatos. Mochas. Flavors and blends of every kind.

According to founder Howard Schultz, Starbucks’ baristas have to be able to make around 100,000 different variations of drinks.

Drinks are iced, blended, foamed, shaken and flavored. Starbucks lists 11 different kinds of creamers and milks on its U.S. website.

Customers can even specify the number of flavor pumps or the amount of caramel drizzle they want in their beverage.

It’s easy to see how all this creativity can lead to issues with customers getting served in a timely fashion.

Phil Kafarakis, the president and CEO of the International Foodservice Manufacturers’ Association has suggested that Starbucks needs to streamline its menu options to fix the problem.

That may well be. But the problem is, taking away what consumers have gotten used to rarely goes over well. (At least in the beginning.)

But beyond all this, there’s another more fundamental problem that the company is facing.

Consumers are Tapped Out

Earlier this year, the Wall Street Journal ran the headline:

Now, some consumers are hitting their limits. Restaurant chains and some food manufacturers are reporting sliding sales or slowing growth that they attribute to consumers’ inability—or refusal—to pay prices that are in some cases a third higher than prepandemic times.

This is a particular problem for a company that brands itself as a luxury item for the masses. (At a Manhattan Starbucks, a medium Pumpkin Spice Latte is now almost $8.)

The problem is coffee is a commodity, plain and simple.

Starbucks has always excelled at transforming that commodity into a customer “experience.” But today, when the customer experience has become “this costs too damn much” you’ve got to acknowledge it.

Brian Niccols officially took over duties as Starbucks’ CEO in early September.

And he’ll undoubtedly get his grace period as CEO. It’s even possible that the August pop may continue for a bit.

But in the end, Niccol and Starbucks are ultimately going to have to deal with a consumer base that’s getting squeezed harder and harder by economic conditions.

If they don’t, the “Niccol jolt” will wear off like any other caffeine buzz.