The bogeyman of AI stocks has been summoned.

In late January, Chinese artificial intelligence company DeepSeek released an open source Large Language Model rivaling OpenAI’s ChatGPT, Google’s Gemini and Meta’s Llama.

The LLM, which was supposedly developed in only a few months with a budget under $6 million, is significantly more efficient than competitors and, consequently, 20 to 50 times cheaper to use than OpenAI’s o1 model.

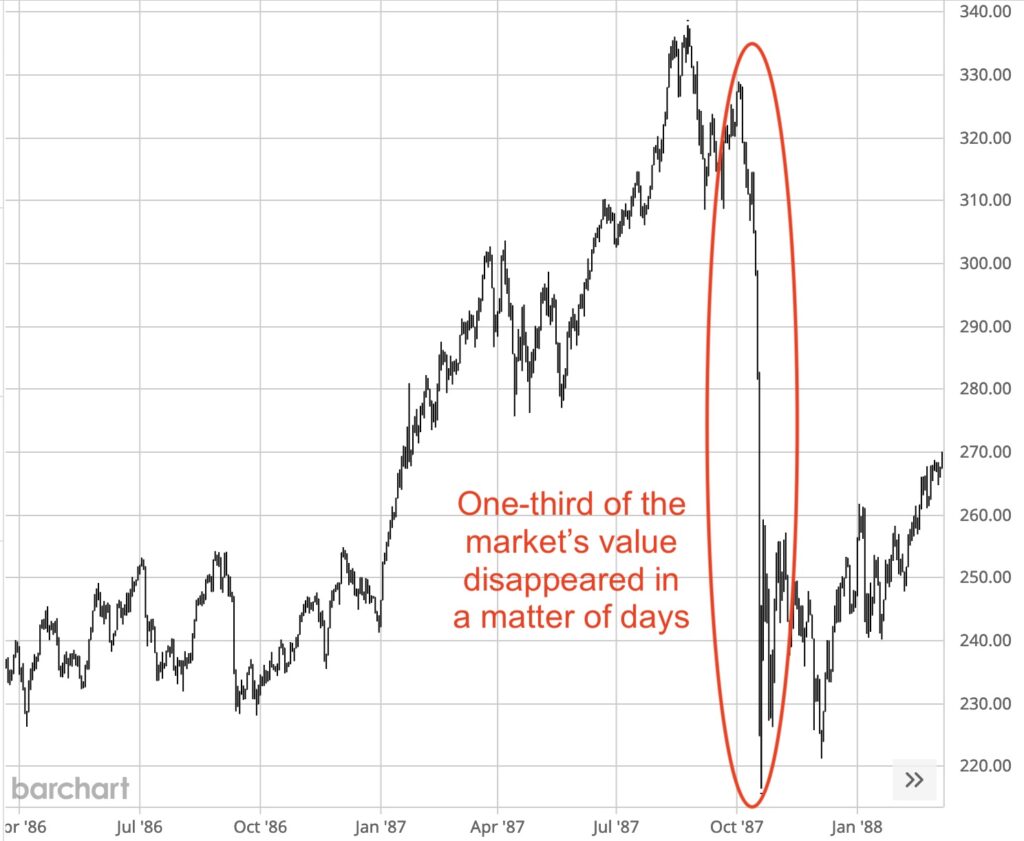

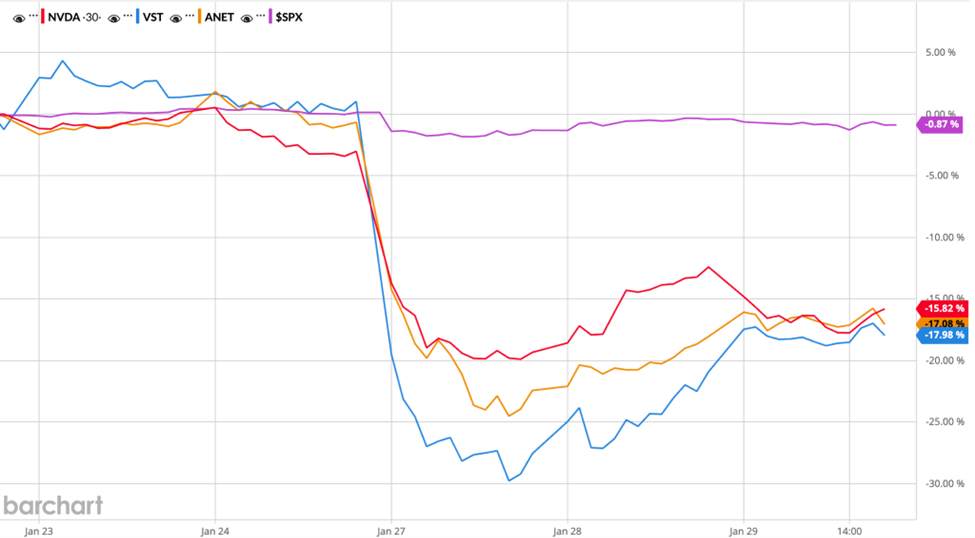

The stock market’s reaction to the DeepSeek release was immediate, and, for a hot minute, there was blood in the streets on stocks even tangentially related to AI.

Tech darling Nvidia’s (NASDAQ: NVDA) shares plummeted nearly 18%, marking the largest single-day loss in its history and setting a new record for the biggest one-day loss for a single company in U.S. stock market history, erasing approximately $465 billion from Nvidia’s market cap.

The day’s other big losers included Vistra Corp (NYSE: VST), an electricity generation conglomerate with significant nuclear power holdings, and Arista Networks (NYSE: ANET), a purveyor of (among other things) cloud networking services for large AI data centers.

As if that wasn’t enough for the poor, beleaguered markets …

… after a small bounce back, additional volatility hit the market later that week as President Trump announced tariffs on trade with Mexico, Canada and China.

The tariff threat was later rolled back (for now) … but many retail investors are still reeling from the amount of uncertainty injected into the markets in a relatively short period.

So what’s the best way to take advantage of the trend?

3 Ways to Play a Crazy Market

If you’re looking to protect your portfolio while still capturing upside, you have a few options.

1. Defend

When markets get choppy, stable, dividend-paying stocks could help smooth out the ride.

Companies that sell essential products or services like food, beverages, and personal products tend to weather stock-market hurricanes with a reassuring stability.

Johnson & Johnson (NYSE: JNJ) is a classic example. With its mix of pharmaceuticals, medical devices, and consumer health products, JNJ has reliably provided investors with a port in the storm for decades.

Plus, with a 3% dividend yield and a low beta of 0.55, it provides reliable income and lower volatility — an excellent safe harbor in turbulent times.

Another “classic” example would be one of Warren Buffett’s favorite investments — Coca-Cola (NYSE: KO). This beverage behemoth has provided Buffett with stunning returns in the vicinity of 2,437% over the last few decades … while providing up to $700 million in dividends annually.

Neither stock dramatically outperforms the S&P until you zoom your chart out to 30+ years … but then again, the S&P doesn’t pay dividends.

If you are looking for longer-term, reasonably reliable gains while also receiving an income from dividends, playing “defense” could be a good strategy for your portfolio.

2. Parry

In fencing terms, a “parry” is a move that both defends and sets up for an attack … and that might be just the right move for a certain type of investor when the market’s going nuts.

This type of investor might consider using that volatility to their advantage by “buying the dip” when a high performing stock with solid fundamentals suddenly lurches downward.

In the DeepSeek panic noted above, several solid companies plunged more than 15% … but a few days later two of the three had rebounded as much as 20% from trough to peak.

Investors who kept their wits about them during the chaos of trading on January 28 had the opportunity to pick up some well performing, large cap stocks at a pretty decent discount and see an immediate ROI.

This is a more aggressive play, so be cautious as you are doing your due diligence on a potential investment; more than one investor has bled trying to catch a falling knife.

3. Attack

The most aggressive play — the high risk, high reward option — is to lean into the volatility and try to seek out an aggressive growth stock in the sector that’s primed to deliver outsized returns.

For example, President Trump’s outspoken desire to unleash American energy as a tool for American prosperity has the potential to dramatically affect the domestic oil and gas landscape.

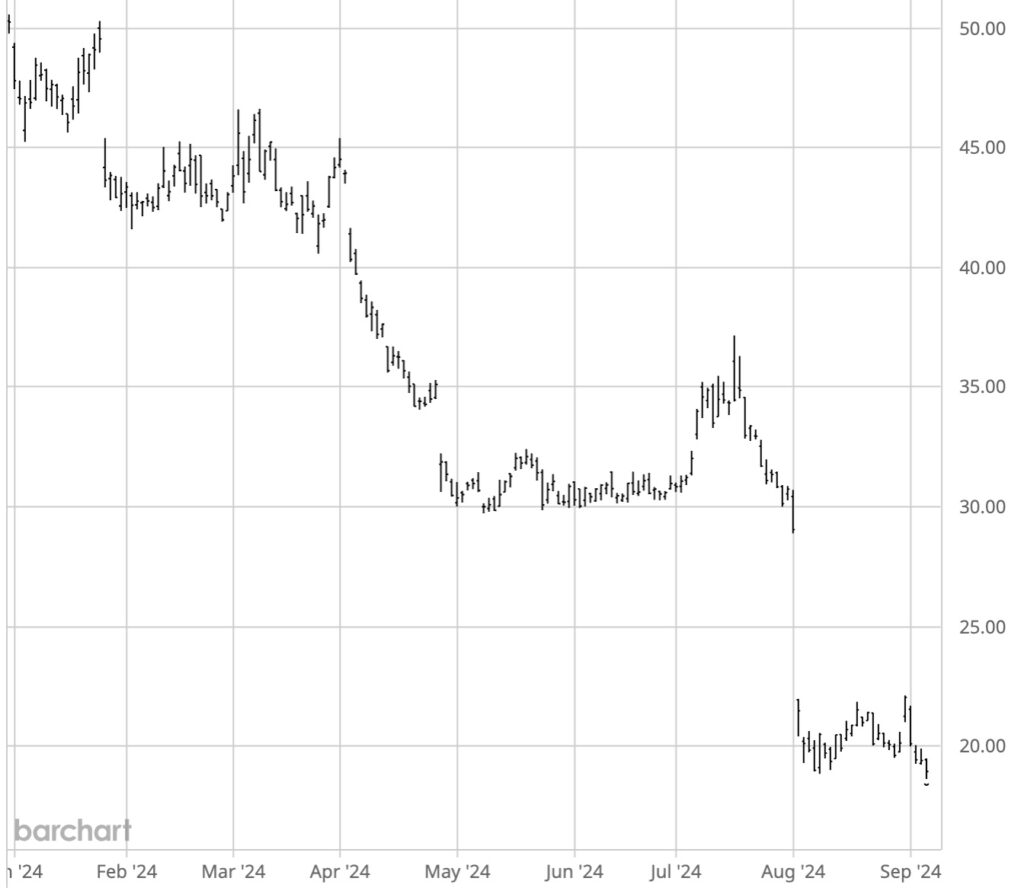

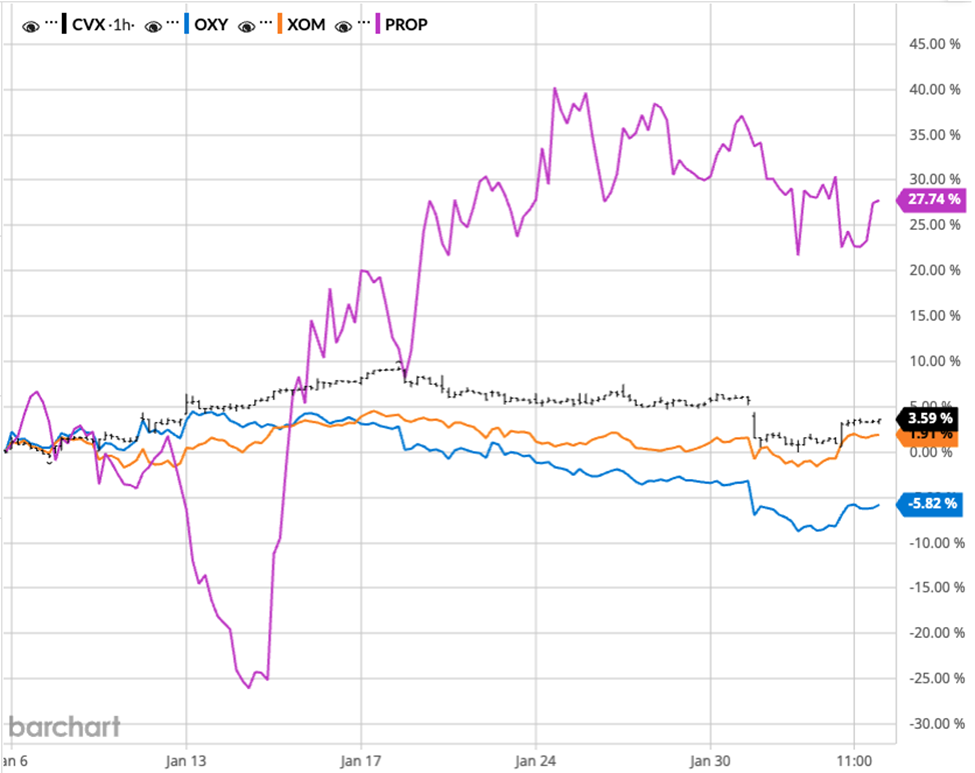

His “Drill, baby, drill!” rhetoric hasn’t yet moved the needle for major producers like Chevron (NYSE: CVX), Occidental Petroleum (NASDAQ: OXY) or ExxonMobile (XOM) … but some smaller producers like Prairie Operating Co. (NASDAQ: PROP) have seen dramatic double-digit stock growth over the last month.

The growth isn’t the only thing dramatic about Prairie’s chart. The more observant readers will notice that the swings between company’s peaks and troughs are significantly larger than the bigger producers … but in that volatility lies the potential for what could be explosive growth.

Warning: Math Ahead

As of this writing, the stock is sitting around $8.60 with a $197.38 million market cap. The company released a 2025 EBITDA forecast between $100 million and $140 million and capex estimated at roughly $100 million for 2025. Additionally, the company has relatively low debt.

Based on a valuation formula called the Enterprise Multiple, some back-of-the-napkin math indicates that the company is currently trading at a 1.58x-2.21x multiple.

What does this mean?

It suggests that PROP is potentially undervalued compared to its peers — trading at a relatively low multiple compared to the broader oil and gas industry, which typically sees EV/EBITDA multiples between 4x and 8x.

If the company’s stock starts trading more in line with the industry average, the market cap could shoot up anywhere between $396 million to $1.096 billion.

That’s a huge range … and it’s not guaranteed that Prairie will ever hit those lofty heights.

But with Trump shouting from the rooftops that American energy is going to see a renaissance … this company could potentially be an aggressive investor’s vehicle to fairly significant returns.

The bottom line?

No matter how you choose to play market turmoil — defend, parry or attack — volatility isn’t necessarily something to fear …

… It’s something you could potentially profit from.

Make a plan, do your due diligence, then execute.