An important lesson that investors need to always keep in mind is that market indexes don’t necessarily represent the market.

There are nearly 6,000 companies that are publicly traded on US stock exchanges.

Standard & Poors’ index only tracks 500. The Dow Jones Industrial Average only follows 30!

(It can be argued that the Nasdaq composite actually does represent all 3,000 or so stocks listed on its exchange, but it’s a capitalization weighted index giving more influence to its bigger constituents.)

And it’s not uncommon for poorly performing companies to be swapped out for stronger ones. A fate two (formerly big) tech names are facing right now…

Poor Intel

It’s been a bad couple years for Intel.

Once the 800-pound gorilla of the semiconductor industry, the company has stumbled to the verge of bankruptcy.

They missed out on the mobile revolution.

Then they whiffed on the AI chip movement.

The $20 billion that was promised from the Biden administration’s Chips and Science Act hasn’t been delivered because they haven’t met the necessary milestones on their two new fabrication plants.

Now they’re scrambling to split their design and fabrication business to try and generate some outside revenue.

The company’s stock has been on a steady trend lower, losing as much as half its value year-to-date thanks to consistently falling earnings.

And as you might guess, their performance has been a drag on the Dow Industrial Average. Intel has long been one of the 30 “Industrial” companies that make up the index.

It’s not any more…

(Reuters) -Intel (INTC) will be replaced by Nvidia (NVDA) on the blue-chip Dow Jones Industrial Average index after a 25-year run, underscoring the shift in the chipmaking market and marking another setback for the struggling semiconductor firm.

Nvidia will join the index next week along with paint-maker Sherwin-Williams , which will replace Dow, S&P Dow Jones Indices said on Friday.

Nvidia vs. Intel (YTD)

Everyone loves a winner.

More Tech Troubles

Another AI stock is in the dog house in a big way as well.

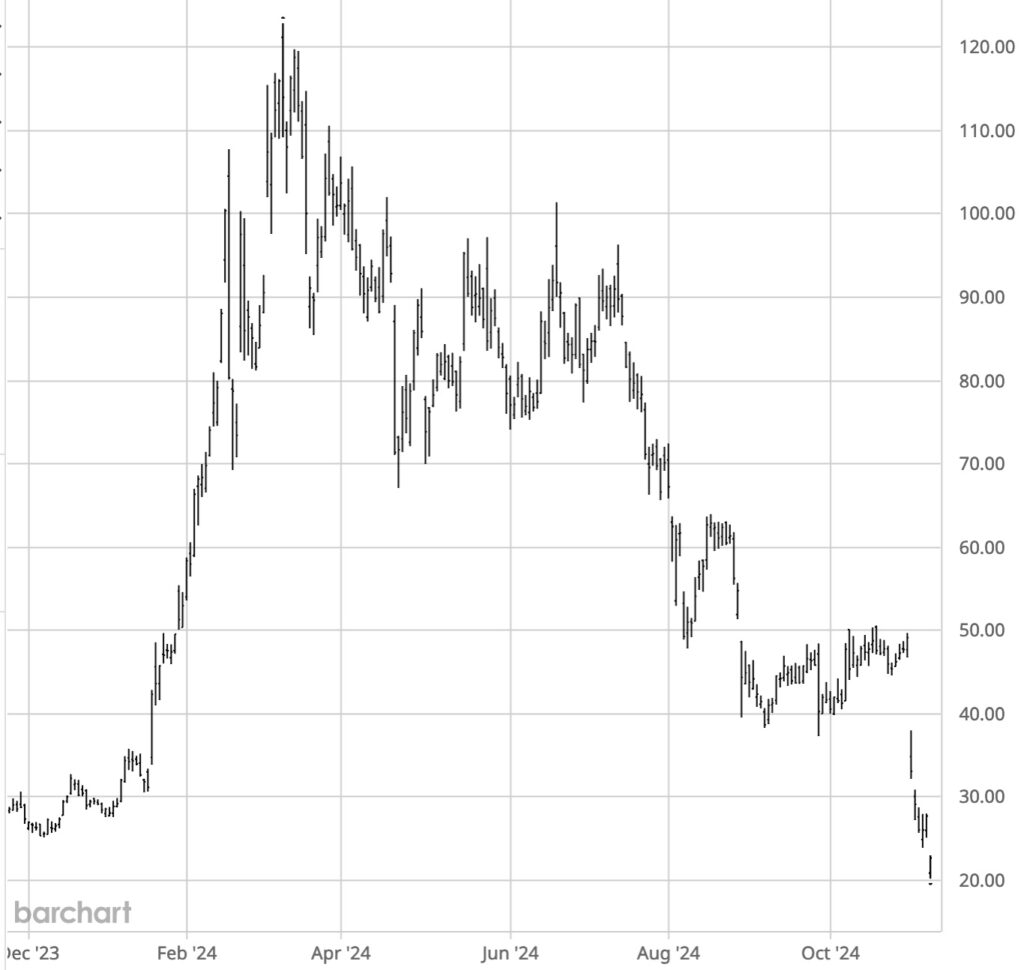

Super Micro Computer Inc. (SCMI) was also once a darling of the AI boom. SCMI produces the server machines which run Nvidia’s chips to train AI algorithms. Trading around $7 at the beginning of 2023 (post split prices), the company’s fortune exploded with the AI boom sending their stock as high as $118 in a little over a year.

In March it was added to the S&P 500.

A series of serious missteps has cost the company big time. Today the stock is actually facing delisting from the Nasdaq.

Shortly after reaching their all-time highs earlier this year, they tried to raise capital by selling 2 million new shares into the market (diluting current shareholders).

In mid-April, shares plunged another 23% when the company failed to report preliminary results in its earnings announcement. (Something it had done religiously before.)

In early May, the company nose-dived again when it reported a revenue miss in its Q3 numbers.

Despite these struggles, the company was added to the Nasdaq-100 index in mid-summer. (The BIG tech slice of the broader index.)

In August the company announced flat guidance which disappointed the market yet again. And if that wasn’t enough, around the same time, short seller fund Hindenburg Research alleged “accounting manipulation” at the company which led to the DOJ opening an investigation.

Finally in October…

Ernst & Young in its resignation letter said it was “unwilling to be associated with the financial statements prepared by management.” The accountancy also raised concerns about the board’s independence from CEO Charles Liang and “other members of management.”

Last week, the company finally reported unaudited Q1 results — which missed expectations. They also reported that an independent investigation turned up no evidence of fraud or misconduct.

That had to be taken with a grain truckload of salt. But the damage has been done.

Super Micro Computer Inc. (SMCI) YTD

What’s the outcome of all this news?

Where Intel goes, losing its spot in the Dow average is certainly a blow that adds insult to injury. But it could also lead to some further selling pressure in the stock as ETFs that track the Dow will have to sell their INTC holdings and replace them with NVDA.

Like we’ve said before, Intel has its comeback work cut out for it.

SMCI on the other hand, has more at risk.

Facing delisting by the Nasdaq exchange would take them out of both indexes. But more importantly, its current struggles have caused one of its major partners — Nvidia — to shift orders to other suppliers indicating that its internal issues may be affecting business relationships. With competition in the AI niche heating up, the loss of any revenue could be a serious problem.

And the final moral of the story, when companies start to struggle, indexes can just take out the trash.